b&o tax credit

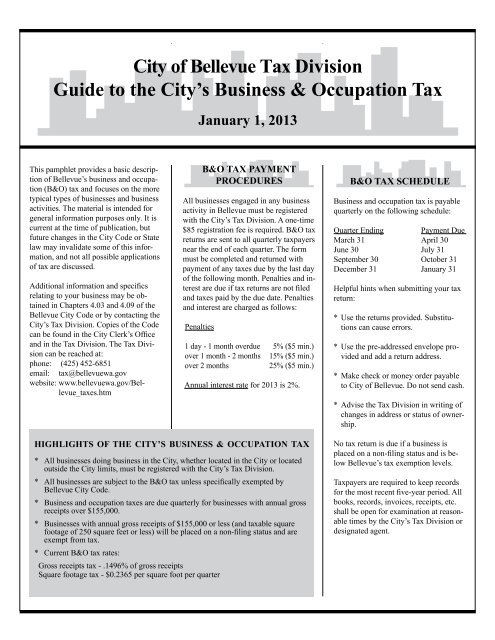

71 for monthly taxpayers. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

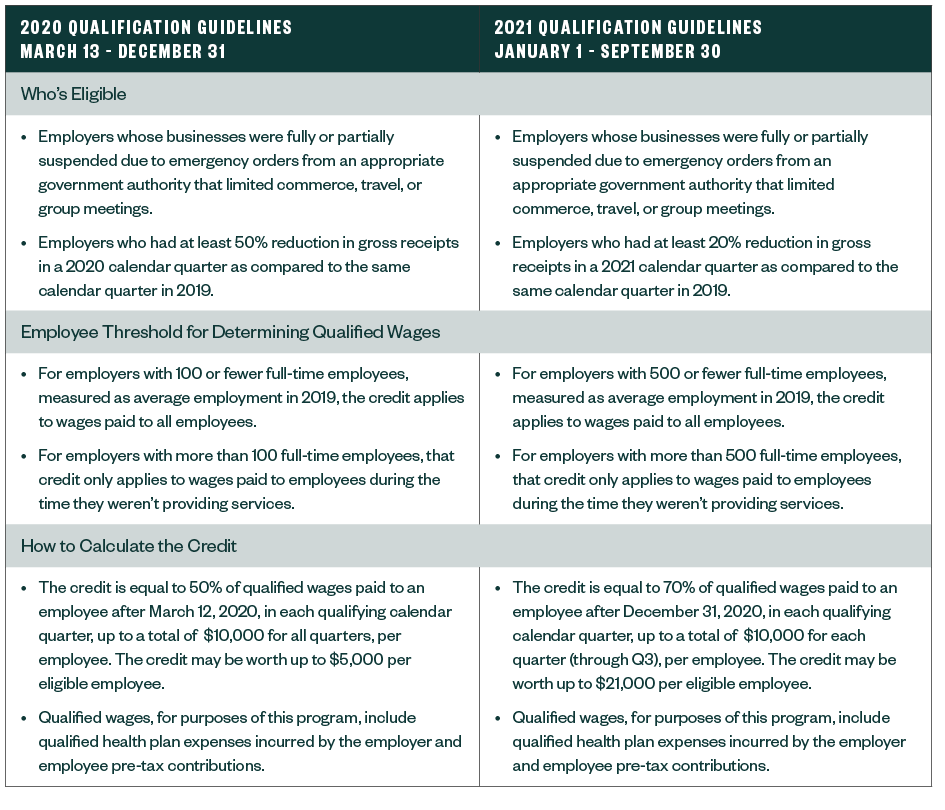

Washington State B O Tax Guidelines For Covid Relief

Business Occupation BO Tax Credits.

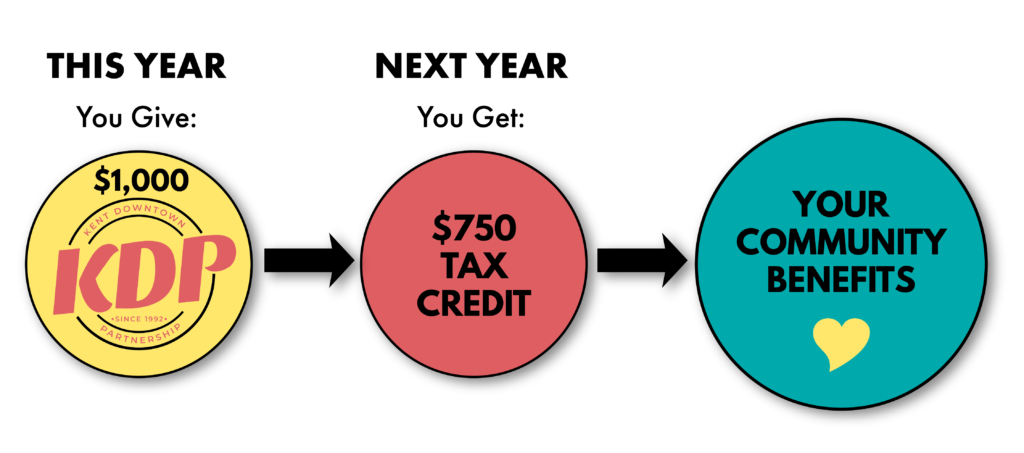

. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5. Syrup must be used by the buyer in making carbonated drinks sold by the buyer. Make a pledge of as little as 1000 to Puyallup Main Street Association beginning January 14 2019 pay the pledge to PMSA by November 15th and 75 of your pledge will be deducted from.

211 for quarterly taxpayers. The credit increases each year. What are the penalties for unpaid BO Tax.

What is the BO tax credit. The following requirements must be met in order to take this BO tax credit. At this point Company B owes Seattle 129.

841 for annual taxpayers. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. Syrup must be used by the buyer in making carbonated drinks sold by the buyer.

The two tax amounts owed are different because Seattle and Bellevue have different tax rates. And it owes Bellevue 8976. Effective June 7 2006 businesses that participate in the Washington Customized Training Program may take a BO tax credit for 50 percent of their payment to the training program.

There is no income tax in Washington State. If you qualify the Department of Revenue provides worksheets to figure out. BO taxes do not allow for any deductions for business expenses with the exception of gross receipts a business earned in another state such as Oregon.

For businesses that exceed that amount a tax credit is granted so that tax applies only to. Members of Wheeling City Council now will vote in early February on a one-time BO Tax credit program for small businesses that was approved by the citys Finance Committee. Washington BO Tax Credits.

Make a pledge of as little as 1000 to Puyallup Main Street Association beginning January 10 to March 30 2022 pay the pledge to PMSA by November 15th and 75 of your pledge will be. 4000 BO tax credit for each qualified position created. Requirements for the BO tax credit.

Credit must be claimed in the tax reporting period when the syrup. 2000 BO tax credit for each qualified position created with annual wagesbenefits of 40000 or less. The small business BO tax credit should be computed after claiming any other BO tax credits available under Title 82 RCW Excise taxes.

Company B then fills. An ordinance of the Council of the City of Fairmont enacted in part pursuant to the provisions of West Virginia Code Section 8-1-5a Municipal. For this reason the Department of Revenue does not allow deductions for a Washington LLC or corporation paying.

Your BO tax liability is under. A reduced tax credit would apply. The bill would increase the small-business BO tax credit to effectively exempt the first 125000 in gross receipts for all qualifying businesses.

The Gross Receipts Tax applies if gross income in Kent exceeds 250000 for the calendar year. Examples of other BO tax credits to be taken.

B Amp O Tax Guide City Of Bellevue

Auburn Studies First Draft Of Proposed B O Tax Auburn Reporter

Projects Programs Kent Downtown Partnership

B O Tax Credit Incentive Program Downtown Waterfront

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

B O Tax Credit Program Sumner Main Street Association

Thousands Of Washington Businesses Could Get A Tax Break King5 Com

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Business Occupation Tax Bainbridge Island Wa Official Website

Walegislativeauditor Walegauditor Twitter

B O Tax Incentive Updates Historic Downtown Prosser

Gig Harbor Downtown Waterfront Alliance Your B O Taxes Can Stay Right Here In Gig Harbor Through The Washington Main Street B O Tax Credit Program Good For Your Business Good For The

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Wheeling Finance Committee Approves B O Tax Credit Lede News

Allocate Your B O Tax Historic Downtown Kennewick Partnership

B O Tax Program Puyallup Main Street Association

Main Street Tax Incentive Program Downtown Bellingham

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association